Understanding Cryptocurrency Regulations Around the World

- The Evolution of Cryptocurrency Regulations

- Key Regulatory Bodies in the Cryptocurrency Space

- Challenges Faced by Regulators in Regulating Cryptocurrencies

- Cryptocurrency Regulations in Major Economies

- Impact of Regulations on the Cryptocurrency Market

- Future Trends in Cryptocurrency Regulation

The Evolution of Cryptocurrency Regulations

Cryptocurrency regulations have evolved significantly over the years as governments around the world grapple with how to address this new form of digital currency. Initially, many countries took a hands-off approach, viewing cryptocurrencies as a niche market with limited impact on the traditional financial system. However, as the popularity of cryptocurrencies like Bitcoin and Ethereum grew, regulators began to take notice and started to implement rules to govern their use.

One of the key issues that regulators have had to contend with is how to classify cryptocurrencies. Some countries have deemed them as commodities, while others have classified them as securities or even currencies. This classification has a significant impact on how cryptocurrencies are regulated, as each category comes with its own set of rules and requirements.

Another area of concern for regulators is the potential for cryptocurrencies to be used for illegal activities such as money laundering and terrorism financing. To address this, many countries have implemented know your customer (KYC) and anti-money laundering (AML) regulations for cryptocurrency exchanges and wallet providers. These regulations require these entities to verify the identity of their customers and report any suspicious transactions to the authorities.

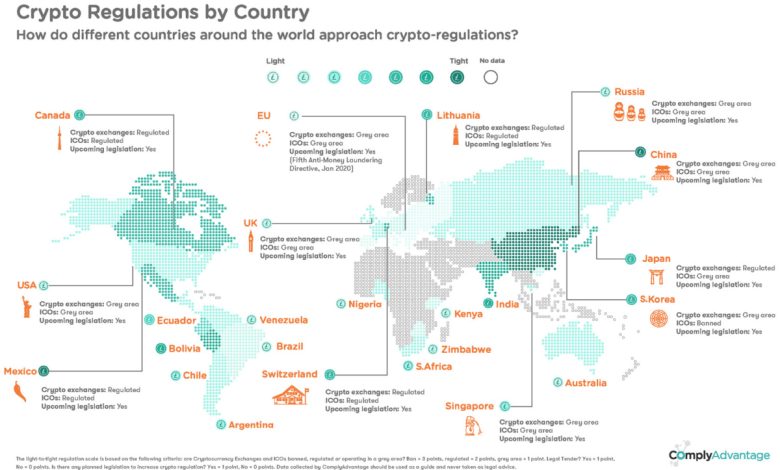

Despite the efforts of regulators to create a framework for the use of cryptocurrencies, there is still a lack of consistency in how they are regulated around the world. Some countries have embraced cryptocurrencies and have created a supportive regulatory environment, while others have taken a more cautious approach and have imposed strict restrictions on their use. This lack of uniformity has created challenges for businesses operating in the cryptocurrency space, as they must navigate a complex web of regulations that vary from country to country.

In conclusion, the evolution of cryptocurrency regulations is an ongoing process as regulators seek to strike a balance between fostering innovation and protecting consumers. As the cryptocurrency market continues to mature, it is likely that we will see further developments in regulations to address new challenges and opportunities that arise.

Key Regulatory Bodies in the Cryptocurrency Space

Regulatory bodies play a crucial role in overseeing the cryptocurrency space to ensure compliance with laws and regulations. Here are some key regulatory bodies that have an impact on the cryptocurrency industry:

- The Financial Crimes Enforcement Network (FinCEN): FinCEN is a bureau of the U.S. Department of the Treasury that focuses on preventing and combating money laundering and terrorist financing. It requires cryptocurrency exchanges to register as money services businesses and comply with anti-money laundering (AML) regulations.

- The Securities and Exchange Commission (SEC): The SEC regulates securities markets in the United States and has been actively involved in overseeing initial coin offerings (ICOs) and token sales to determine if they fall under securities laws.

- The Commodity Futures Trading Commission (CFTC): The CFTC regulates the derivatives markets in the U.S. and has jurisdiction over cryptocurrency derivatives. It works to ensure fair and transparent trading practices in the cryptocurrency futures and options markets.

- The European Securities and Markets Authority (ESMA): ESMA is an independent EU authority that works to enhance investor protection and promote stable and orderly financial markets. It has issued warnings about the risks associated with investing in cryptocurrencies.

- The Financial Conduct Authority (FCA): The FCA is the regulatory body for financial services firms in the UK. It has issued guidance on cryptocurrency regulations and works to protect consumers and maintain the integrity of the financial markets.

These regulatory bodies play a critical role in shaping the regulatory environment for cryptocurrencies around the world. By monitoring and enforcing compliance with laws and regulations, they aim to protect investors and maintain the stability of the financial system.

Challenges Faced by Regulators in Regulating Cryptocurrencies

Regulators face numerous challenges when it comes to regulating cryptocurrencies. One of the main issues is the decentralized nature of cryptocurrencies, which makes it difficult for traditional regulatory bodies to monitor and control. This lack of central authority means that there is no single entity that can be held accountable for any wrongdoing in the cryptocurrency space.

Another challenge is the rapid pace at which the cryptocurrency market evolves. New cryptocurrencies and technologies are constantly being developed, making it hard for regulators to keep up with the changing landscape. This can lead to gaps in regulation and enforcement, leaving investors vulnerable to fraud and manipulation.

Additionally, the global nature of cryptocurrencies presents a challenge for regulators, as different countries have varying regulations and approaches to cryptocurrencies. This lack of uniformity can create confusion and uncertainty for businesses and investors operating in multiple jurisdictions.

Furthermore, the anonymity and pseudonymity offered by cryptocurrencies make it difficult for regulators to track and trace transactions, which can be exploited for illicit activities such as money laundering and terrorist financing. This poses a significant challenge for law enforcement agencies trying to combat financial crimes in the cryptocurrency space.

In conclusion, regulators face a multitude of challenges in regulating cryptocurrencies, from the decentralized nature of the market to the rapid pace of innovation and the global regulatory fragmentation. Addressing these challenges will require collaboration and coordination among regulators at both the national and international levels to develop effective and coherent regulatory frameworks for the cryptocurrency industry.

Cryptocurrency Regulations in Major Economies

Regulations surrounding cryptocurrencies vary significantly across major economies around the world. It is essential for investors and users to understand the legal framework in place to ensure compliance and mitigate risks. Here is an overview of cryptocurrency regulations in some of the world’s largest economies:

- United States: In the US, cryptocurrencies are considered legal, but they are subject to regulatory oversight by various agencies such as the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). The IRS also requires individuals to report cryptocurrency transactions for tax purposes.

- China: China has taken a strict stance on cryptocurrencies, banning initial coin offerings (ICOs) and cracking down on cryptocurrency exchanges. However, the country has been exploring the development of its digital currency.

- European Union: The EU has not implemented a unified approach to cryptocurrency regulation, with each member state having its own set of rules. However, the EU’s Fifth Anti-Money Laundering Directive requires cryptocurrency exchanges to adhere to KYC and AML regulations.

- Japan: Japan has been one of the most progressive countries in terms of cryptocurrency regulation, recognizing Bitcoin as legal tender and licensing cryptocurrency exchanges through the Financial Services Agency (FSA).

- India: India has had a tumultuous relationship with cryptocurrencies, with the Reserve Bank of India (RBI) imposing a banking ban on crypto transactions that was later overturned by the Supreme Court. The government is currently considering a bill to regulate cryptocurrencies.

It is crucial for individuals and businesses involved in the cryptocurrency space to stay informed about regulatory developments in their respective countries to navigate the evolving landscape effectively.

Impact of Regulations on the Cryptocurrency Market

Regulations play a significant role in shaping the cryptocurrency market landscape globally. The impact of regulations on cryptocurrencies can vary from country to country, influencing the adoption and trading of digital assets. Here are some key points to consider regarding the impact of regulations on the cryptocurrency market:

- **Compliance:** Regulations require cryptocurrency exchanges and businesses to comply with certain standards and guidelines to operate legally. Failure to comply can result in penalties or even shutdowns, affecting market participants.

- **Investor Protection:** Regulations aim to protect investors from fraud, scams, and market manipulation within the cryptocurrency space. This can help build trust and confidence among investors, leading to a more stable market environment.

- **Market Stability:** Regulatory measures can help promote market stability by preventing excessive speculation, price manipulation, and illicit activities. This can create a more sustainable and secure trading environment for participants.

- **Innovation:** While regulations are necessary for investor protection and market stability, they should also allow room for innovation and growth within the cryptocurrency industry. Striking a balance between regulation and innovation is crucial for the long-term success of the market.

- **Global Coordination:** As cryptocurrencies operate on a global scale, regulatory efforts need to be coordinated internationally to address cross-border challenges effectively. Collaboration among regulators can help create a more cohesive regulatory framework for the cryptocurrency market.

Overall, the impact of regulations on the cryptocurrency market is multifaceted, influencing various aspects of the industry. Finding the right balance between regulation, investor protection, market stability, and innovation is essential for the sustainable growth and development of the cryptocurrency market worldwide.

Future Trends in Cryptocurrency Regulation

As the cryptocurrency market continues to evolve, so do the regulations surrounding it. Governments around the world are starting to take notice of the impact that cryptocurrencies can have on their economies and are beginning to implement new rules and guidelines to govern their use. It is important for investors and users alike to stay informed about these changes to ensure compliance and avoid any potential legal issues.

One of the future trends in cryptocurrency regulation is the focus on anti-money laundering (AML) and know your customer (KYC) regulations. Many countries are now requiring cryptocurrency exchanges to implement these measures to prevent illicit activities such as money laundering and terrorist financing. By verifying the identities of their users and monitoring transactions, exchanges can help ensure that cryptocurrencies are being used for legitimate purposes.

Another trend in cryptocurrency regulation is the push for increased consumer protection. With the rise of scams and fraudulent schemes in the cryptocurrency space, regulators are looking to implement measures to safeguard investors and users. This may include requiring exchanges to have insurance coverage, implementing stricter security protocols, and providing better disclosure of risks to consumers.

Additionally, there is a growing trend towards regulating initial coin offerings (ICOs). Regulators are concerned about the lack of transparency and investor protection in the ICO market and are looking to establish guidelines to govern these fundraising activities. This may include requiring companies to disclose more information about their projects, conduct due diligence on investors, and adhere to certain reporting requirements.

Overall, the future of cryptocurrency regulation is likely to involve a balance between fostering innovation and protecting consumers. By staying informed about these trends and complying with regulations, investors and users can help ensure the long-term viability of the cryptocurrency market.