Understanding Market Cycles in the Cryptocurrency World

- Introduction to Market Cycles

- The Four Phases of Market Cycles

- Factors Influencing Cryptocurrency Market Cycles

- Strategies for Navigating Market Cycles

- Case Studies of Past Market Cycles

- Predicting Future Market Cycles in Cryptocurrency

Introduction to Market Cycles

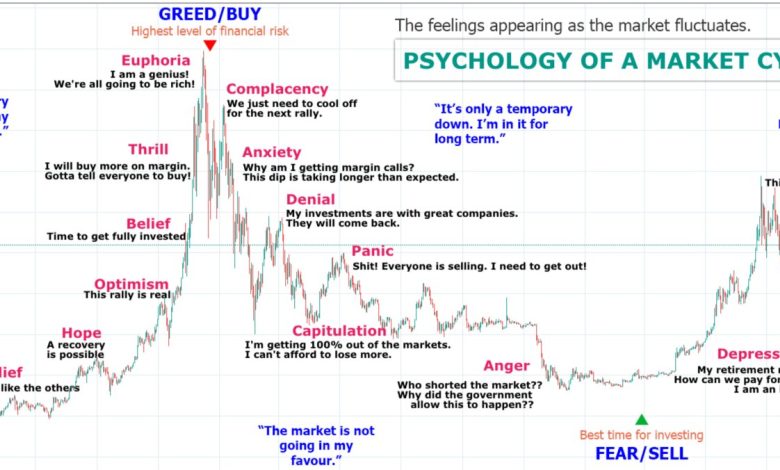

Understanding market cycles in the cryptocurrency world is crucial for investors looking to make informed decisions. Market cycles refer to the recurring patterns of growth and decline in the value of cryptocurrencies over time. By recognizing these cycles, investors can better anticipate market trends and adjust their investment strategies accordingly.

Market cycles are influenced by various factors such as market demand, regulatory developments, technological advancements, and investor sentiment. These factors can cause prices to fluctuate, leading to different phases in the market cycle. The four main phases of a market cycle are accumulation, uptrend, distribution, and downtrend.

During the accumulation phase, prices are generally low as investors start buying assets in anticipation of future growth. This is followed by the uptrend phase, where prices steadily increase as more investors enter the market. The distribution phase occurs when prices reach a peak and investors begin to sell off their assets. Finally, the downtrend phase sees prices declining as selling pressure outweighs buying pressure.

It is essential for investors to recognize these market cycles and understand how they can impact their investments. By studying historical data and market trends, investors can gain valuable insights into the behavior of cryptocurrencies and make more informed decisions. Additionally, staying informed about market news and developments can help investors anticipate changes in market cycles and adjust their strategies accordingly.

The Four Phases of Market Cycles

The four phases of market cycles in the cryptocurrency world are crucial to understand for investors looking to navigate the volatile nature of this market. These phases can help predict trends and make informed decisions about buying and selling digital assets.

**Phase 1: Accumulation**

During the accumulation phase, prices are typically low, and smart investors start buying up assets at discounted prices. This phase is characterized by low trading volumes and little public interest in the cryptocurrency.

**Phase 2: Markup**

As demand for the cryptocurrency increases, prices start to rise rapidly during the markup phase. This is when the general public starts to take notice of the asset, leading to a surge in trading volumes and media attention.

**Phase 3: Distribution**

In the distribution phase, prices reach their peak as early investors begin to sell off their holdings. This phase is marked by decreasing trading volumes and a shift in sentiment from bullish to bearish.

**Phase 4: Markdown**

The markdown phase is when prices plummet as panic selling ensues. This phase is often accompanied by negative news and a general sense of fear in the market. However, savvy investors see this as an opportunity to buy assets at rock-bottom prices in preparation for the next accumulation phase.

Understanding these four phases of market cycles can help investors make more informed decisions and capitalize on the opportunities presented by the ever-changing cryptocurrency landscape. By recognizing these patterns, investors can better navigate the ups and downs of the market and position themselves for long-term success.

Factors Influencing Cryptocurrency Market Cycles

Various factors play a crucial role in influencing the market cycles of cryptocurrencies. Understanding these factors can help investors make informed decisions and navigate the volatile nature of the cryptocurrency market. Some of the key factors influencing cryptocurrency market cycles include:

- Market Sentiment: The overall sentiment of investors towards cryptocurrencies can heavily impact market cycles. Positive news and developments can lead to bullish trends, while negative news can trigger bearish trends.

- Regulatory Environment: Regulations imposed by governments and regulatory bodies can significantly affect the cryptocurrency market. Uncertainty or strict regulations can lead to market fluctuations.

- Market Manipulation: The cryptocurrency market is susceptible to manipulation by whales and large investors. Manipulative practices such as pump-and-dump schemes can distort market cycles.

- Technological Developments: Innovations and advancements in blockchain technology can impact the value and adoption of cryptocurrencies. New technological developments can influence market cycles.

- Market Adoption: The level of adoption of cryptocurrencies in mainstream markets and industries can influence market cycles. Increased adoption can lead to positive price movements.

By considering these factors and staying informed about market trends, investors can better understand the dynamics of cryptocurrency market cycles and make strategic investment decisions.

Strategies for Navigating Market Cycles

One effective strategy for navigating market cycles in the cryptocurrency world is to **diversify** your investment portfolio. By spreading your investments across different cryptocurrencies, you can **reduce** the risk of being heavily impacted by the **volatility** of a single asset. This approach can help you **mitigate** potential losses during market downturns while still allowing you to **capitalize** on the growth of other assets.

Another important strategy is to **stay informed** about market trends and developments. By keeping up to date with the latest news and analysis, you can make **informed** decisions about when to buy or sell your cryptocurrencies. This **knowledge** can give you a **competitive** edge in navigating market cycles and **maximizing** your returns.

Additionally, it is crucial to have a **long-term** perspective when investing in cryptocurrencies. Market cycles are **inevitable**, but by focusing on the **fundamentals** of the technology and the **potential** for long-term growth, you can **weather** the ups and downs of the market. **Patience** and **discipline** are key virtues for successful cryptocurrency investors.

Furthermore, consider using **dollar-cost averaging** as a strategy for navigating market cycles. By **regularly** investing a fixed amount of money into cryptocurrencies, you can **smooth** out the impact of **price fluctuations** over time. This approach can help you **avoid** making emotional decisions based on short-term **market movements**.

In conclusion, understanding market cycles in the cryptocurrency world is essential for **successful** investing. By diversifying your portfolio, staying informed, taking a long-term perspective, and using dollar-cost averaging, you can navigate market cycles with **confidence** and **strategic** foresight. Remember that **patience** and **discipline** are key to **achieving** your investment goals in this **dynamic** and **ever-changing** market.

Case Studies of Past Market Cycles

Studying past market cycles in the cryptocurrency world can provide valuable insights into how these digital assets behave over time. By analyzing historical data, investors can better understand the patterns and trends that have emerged in the market. Here are some case studies of past market cycles that can help shed light on the dynamics of the cryptocurrency market:

- Bitcoin Bull Run of 2017: In 2017, Bitcoin experienced a massive bull run that saw its price skyrocket to an all-time high. This surge in value was driven by a combination of factors, including increased mainstream adoption and media attention. However, the bull run was followed by a sharp correction, leading to a prolonged bear market.

- Ethereum’s ICO Boom: Ethereum’s Initial Coin Offering (ICO) boom in 2017 also contributed to a significant market cycle. Many new projects launched on the Ethereum platform, raising millions of dollars through token sales. This influx of capital fueled a period of rapid growth for Ethereum and the broader cryptocurrency market.

- The Crypto Winter of 2018: Following the highs of 2017, the cryptocurrency market entered a prolonged bear market in 2018. Prices plummeted, and many projects struggled to survive. This period, known as the “crypto winter,” tested the resilience of the industry and separated the strong projects from the weak.

By examining these case studies and others, investors can gain a better understanding of the cyclical nature of the cryptocurrency market. While past performance is not indicative of future results, studying market cycles can help investors make more informed decisions and navigate the volatile world of cryptocurrencies.

Predicting Future Market Cycles in Cryptocurrency

When it comes to predicting future market cycles in the cryptocurrency world, it is essential to analyze historical data and trends. By examining past market cycles, investors and traders can gain valuable insights into potential future movements. One common approach is to look at the patterns of bull and bear markets that have occurred in the past. These cycles typically involve periods of rapid price increases followed by sharp declines.

Another key factor to consider when predicting future market cycles is the overall market sentiment. Sentiment analysis involves assessing the emotions and attitudes of market participants towards a particular cryptocurrency. By monitoring social media, news articles, and forums, investors can gauge the overall sentiment and use this information to make informed decisions about future market movements.

Technical analysis is also a crucial tool for predicting future market cycles in the cryptocurrency world. This involves studying price charts, volume, and other market indicators to identify patterns and trends. By using technical analysis, traders can make educated guesses about potential future price movements and adjust their strategies accordingly.