The Role of Self-Regulation in the Cryptocurrency Industry

- Understanding the importance of self-regulation in the cryptocurrency industry

- Challenges faced by the cryptocurrency industry in implementing self-regulation

- The impact of self-regulation on investor confidence in cryptocurrencies

- Exploring the role of government regulations in shaping the cryptocurrency market

- Benefits of self-regulation for promoting innovation and growth in the cryptocurrency sector

- Comparing self-regulation practices in different cryptocurrency exchanges

Understanding the importance of self-regulation in the cryptocurrency industry

Understanding the significance of self-regulation in the cryptocurrency industry is crucial for ensuring its long-term sustainability and credibility. Self-regulation refers to the voluntary compliance of industry participants with a set of standards and best practices to promote transparency, security, and trust among users. In an industry known for its decentralized nature and lack of traditional oversight, self-regulation plays a vital role in fostering a safe and reliable environment for investors and users.

By implementing self-regulatory measures, cryptocurrency companies can demonstrate their commitment to ethical business practices and consumer protection. This can help to mitigate risks such as fraud, money laundering, and market manipulation, which have been prevalent in the industry due to its relatively unregulated nature. Moreover, self-regulation can also help to improve the industry’s reputation and legitimacy in the eyes of regulators, policymakers, and the general public.

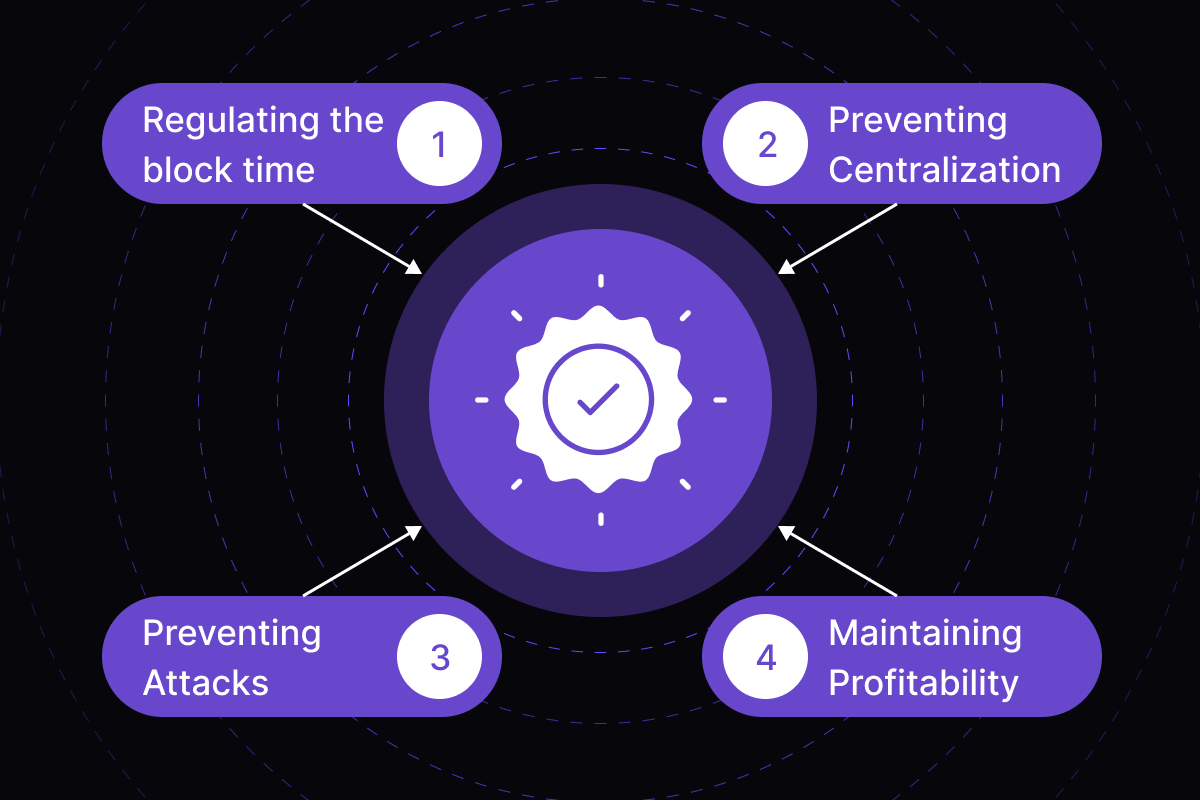

Self-regulation in the cryptocurrency industry can take various forms, including the establishment of industry standards, codes of conduct, and self-regulatory organizations. These initiatives can help to set guidelines for best practices in areas such as security, privacy, and compliance with regulatory requirements. By adhering to these standards, companies can build trust with their users and differentiate themselves from less reputable actors in the industry.

Overall, self-regulation is essential for promoting the growth and maturation of the cryptocurrency industry. By voluntarily adopting and enforcing industry standards, companies can help to create a more stable and secure environment for users and investors. This, in turn, can lead to increased adoption of cryptocurrencies and blockchain technology, driving innovation and economic growth in the digital asset space.

Challenges faced by the cryptocurrency industry in implementing self-regulation

The cryptocurrency industry faces several challenges when it comes to implementing self-regulation. These challenges stem from the decentralized nature of cryptocurrencies and the lack of a central authority overseeing the market. Some of the key challenges include:

- Volatility: The highly volatile nature of cryptocurrencies makes it difficult to establish consistent regulatory frameworks that can adapt to rapid price fluctuations.

- Security: Security concerns, such as hacking and fraud, pose a significant challenge to self-regulation efforts within the cryptocurrency industry.

- Compliance: Ensuring compliance with regulatory standards across different jurisdictions is a complex task, given the global nature of the cryptocurrency market.

- Transparency: The lack of transparency in cryptocurrency transactions makes it challenging to monitor and enforce self-regulatory measures effectively.

- Public Perception: Negative public perception of cryptocurrencies due to their association with illicit activities can hinder efforts to establish self-regulatory practices.

Despite these challenges, the cryptocurrency industry recognizes the importance of self-regulation in building trust and credibility among investors and regulators. By addressing these challenges and working towards common standards, the industry can enhance its legitimacy and foster sustainable growth in the long term.

The impact of self-regulation on investor confidence in cryptocurrencies

Self-regulation plays a crucial role in shaping investor confidence in the volatile world of cryptocurrencies. When investors see that the industry is taking steps to regulate itself, they are more likely to trust the market and feel secure in their investments. This trust is essential for the long-term growth and stability of the cryptocurrency market.

By implementing self-regulatory measures, the cryptocurrency industry can demonstrate its commitment to transparency, accountability, and investor protection. This, in turn, can attract more investors who are looking for a safe and regulated environment to invest in digital assets. Self-regulation can help weed out bad actors and fraudulent schemes, making the market safer for everyone involved.

Investor confidence is a key driver of the cryptocurrency market. When investors feel confident in the market, they are more likely to buy and hold onto their digital assets, leading to increased trading volumes and market liquidity. On the other hand, a lack of confidence can lead to panic selling and market crashes. Self-regulation can help mitigate these risks by instilling trust and stability in the market.

Overall, the impact of self-regulation on investor confidence in cryptocurrencies cannot be overstated. By promoting trust, transparency, and accountability, self-regulation can help attract more investors to the market and ensure its long-term viability. It is essential for the cryptocurrency industry to continue to develop and implement self-regulatory measures to foster a healthy and thriving market ecosystem.

Exploring the role of government regulations in shaping the cryptocurrency market

Government regulations play a crucial role in shaping the cryptocurrency market. These regulations can have a significant impact on the industry, influencing everything from the legality of cryptocurrencies to how they are traded and used. By imposing regulations, governments can help protect consumers, prevent fraud, and ensure the stability of the market.

One of the main ways in which government regulations affect the cryptocurrency market is by determining the legal status of cryptocurrencies. Some countries have embraced cryptocurrencies and have passed laws to regulate them, while others have banned or restricted their use. This legal uncertainty can have a major impact on the value and adoption of cryptocurrencies.

Government regulations also play a role in shaping how cryptocurrencies are traded. For example, regulations may require cryptocurrency exchanges to comply with anti-money laundering and know your customer laws, which can help prevent illegal activities such as money laundering and terrorist financing. Additionally, regulations may require exchanges to meet certain security standards to protect users’ funds.

Furthermore, government regulations can influence how cryptocurrencies are used in everyday transactions. For example, some countries have imposed taxes on cryptocurrency transactions, while others have taken steps to encourage the use of cryptocurrencies for payments. These regulations can affect the adoption of cryptocurrencies as a means of payment and may impact their value.

In conclusion, government regulations play a crucial role in shaping the cryptocurrency market. By imposing regulations, governments can help protect consumers, prevent fraud, and ensure the stability of the market. However, the impact of these regulations can vary depending on the approach taken by different countries, leading to a complex and evolving regulatory landscape for the cryptocurrency industry.

Benefits of self-regulation for promoting innovation and growth in the cryptocurrency sector

Self-regulation plays a crucial role in promoting innovation and growth in the cryptocurrency sector. By implementing self-regulatory measures, the industry can demonstrate its commitment to transparency, security, and compliance with legal requirements. This, in turn, helps to build trust among investors, users, and regulators, which is essential for the long-term success of the cryptocurrency market.

One of the key benefits of self-regulation is that it allows the industry to address emerging challenges and risks proactively. By establishing best practices and standards, cryptocurrency companies can better protect their customers and mitigate potential threats such as fraud, money laundering, and cyber attacks. This not only enhances the overall security of the ecosystem but also fosters a more stable and resilient market environment.

Furthermore, self-regulation can help to streamline the process of launching new cryptocurrency projects and products. By adhering to industry standards and guidelines, companies can reduce regulatory uncertainty and expedite the approval process. This enables them to bring innovative solutions to market more quickly, driving growth and competitiveness in the sector.

Comparing self-regulation practices in different cryptocurrency exchanges

When comparing self-regulation practices in different cryptocurrency exchanges, it is essential to consider the various measures put in place by these platforms to ensure compliance and security. By examining the approaches taken by exchanges, we can gain insights into the level of commitment to regulatory standards and the protection of users’ assets.

- One key aspect to analyze is the KYC (Know Your Customer) process implemented by exchanges. This procedure involves verifying the identity of users to prevent fraud and money laundering. Exchanges that have robust KYC protocols in place demonstrate a higher level of commitment to regulatory compliance.

- Another important factor to consider is the security measures adopted by exchanges to safeguard users’ funds. This includes the implementation of cold storage wallets, two-factor authentication, and regular security audits. Exchanges that prioritize security are more likely to attract users concerned about the safety of their investments.

- Furthermore, transparency in trading practices is crucial for building trust with users. Exchanges that provide real-time data on trading volumes, order books, and market manipulation prevention measures are perceived as more reliable and trustworthy.

- Additionally, the responsiveness of exchanges to regulatory changes and enforcement actions is indicative of their commitment to self-regulation. Platforms that promptly adapt their policies and procedures in response to evolving regulatory requirements demonstrate a proactive approach to compliance.

In conclusion, by comparing self-regulation practices in different cryptocurrency exchanges, we can assess the industry’s overall commitment to regulatory compliance and user protection. Exchanges that prioritize KYC procedures, security measures, transparency, and adaptability to regulatory changes are more likely to foster trust and credibility among users and regulators alike.