Analyzing the Correlation Between Traditional Markets and Crypto

- Understanding the relationship between traditional markets and cryptocurrencies

- Exploring the impact of economic indicators on both traditional and crypto markets

- Comparing the volatility of stocks and cryptocurrencies during market fluctuations

- Investigating the role of institutional investors in shaping the correlation between traditional and crypto markets

- Analyzing the influence of global events on the interconnectedness of traditional and crypto markets

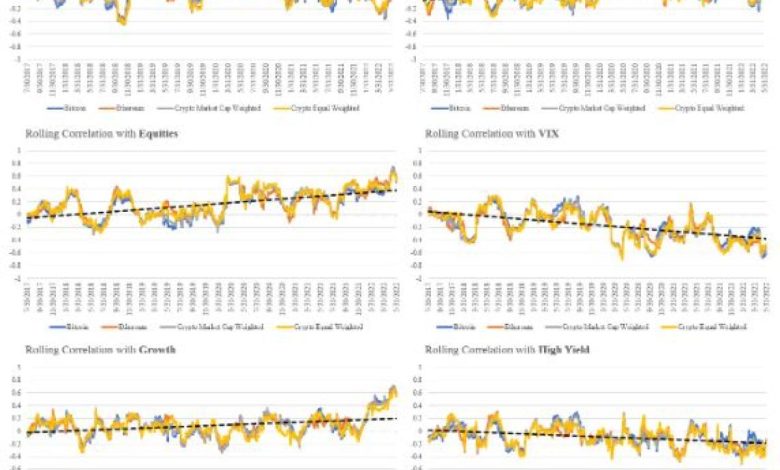

- Predicting future trends by studying historical data of traditional and crypto markets

Understanding the relationship between traditional markets and cryptocurrencies

The relationship between traditional markets and cryptocurrencies is a topic of great interest and debate among investors and analysts. Understanding how these two types of markets interact can provide valuable insights for making informed investment decisions.

One key aspect to consider is the correlation between traditional markets, such as stocks and bonds, and cryptocurrencies like Bitcoin and Ethereum. While some believe that cryptocurrencies are uncorrelated with traditional markets, others argue that there is a significant correlation between the two.

It is important to note that the relationship between traditional markets and cryptocurrencies is complex and multifaceted. Factors such as market sentiment, economic indicators, and geopolitical events can all influence the correlation between these markets.

Investors should also consider the impact of regulatory developments on the relationship between traditional markets and cryptocurrencies. Changes in regulations can have a significant impact on the prices of both traditional assets and cryptocurrencies, leading to increased correlation between the two markets.

Overall, understanding the relationship between traditional markets and cryptocurrencies is essential for investors looking to diversify their portfolios and manage risk effectively. By staying informed and analyzing market trends, investors can make more informed decisions and navigate the dynamic landscape of both traditional and crypto markets.

Exploring the impact of economic indicators on both traditional and crypto markets

When analyzing the correlation between traditional markets and crypto, it is essential to explore the impact of economic indicators on both. Economic indicators play a crucial role in determining the health and direction of financial markets, whether traditional or crypto. These indicators provide valuable insights into the overall economic performance of a country or region, influencing investor sentiment and market trends.

Traditional markets, such as stocks and commodities, are heavily influenced by economic indicators like GDP growth, inflation rates, interest rates, and unemployment figures. Positive economic data can lead to a bullish market sentiment, driving up stock prices and boosting investor confidence. On the other hand, negative economic indicators can trigger a bearish market sentiment, causing stock prices to decline and investors to seek safe-haven assets.

Similarly, in the crypto market, economic indicators can have a significant impact on price movements and market dynamics. Factors such as regulatory developments, adoption rates, technological advancements, and macroeconomic trends can all influence the value of cryptocurrencies. For example, positive regulatory news can lead to a surge in crypto prices, while negative news can cause a sell-off.

Overall, understanding the relationship between economic indicators and market behavior is crucial for investors and traders looking to make informed decisions in both traditional and crypto markets. By staying informed about key economic data releases and developments, market participants can better anticipate market movements and adjust their strategies accordingly.

Comparing the volatility of stocks and cryptocurrencies during market fluctuations

When comparing the volatility of stocks and cryptocurrencies during market fluctuations, it is important to consider the differences in how these assets behave. Stocks are typically more stable and less prone to extreme price swings compared to cryptocurrencies. This is due to the fact that stocks represent ownership in a company, which is backed by tangible assets and revenue streams. On the other hand, cryptocurrencies are digital assets that are not tied to any physical entity, making them more susceptible to market sentiment and speculation.

During times of market turbulence, stocks tend to experience more gradual price movements, reflecting changes in the overall economy and company performance. Cryptocurrencies, on the other hand, can see significant price fluctuations within a short period of time, driven by factors such as regulatory news, technological developments, and investor sentiment.

Investors looking to diversify their portfolios may consider allocating a portion of their investments to both stocks and cryptocurrencies to mitigate risk. By holding a mix of assets with different levels of volatility, investors can potentially achieve a more balanced and stable portfolio. However, it is important to conduct thorough research and due diligence before investing in any asset class, as both stocks and cryptocurrencies carry inherent risks.

Investigating the role of institutional investors in shaping the correlation between traditional and crypto markets

Investigating the role of institutional investors in shaping the correlation between traditional and cryptocurrency markets is crucial in understanding the dynamics of these two asset classes. Institutional investors, such as hedge funds, pension funds, and asset managers, have been increasingly entering the cryptocurrency space, bringing with them a new level of sophistication and capital.

These institutional investors have the potential to influence the correlation between traditional markets, such as stocks and bonds, and cryptocurrencies like Bitcoin and Ethereum. Their entry into the crypto market can lead to increased correlation as they allocate capital across different asset classes based on their risk appetite and investment strategies.

Furthermore, institutional investors often have access to advanced trading tools and analytics, which can impact the overall market sentiment and direction. By analyzing their behavior and investment decisions, we can gain insights into how they shape the correlation between traditional and crypto markets.

Analyzing the influence of global events on the interconnectedness of traditional and crypto markets

The interconnectedness between traditional markets and crypto markets has become increasingly evident in recent years, with global events playing a significant role in shaping this relationship. Analyzing the influence of these events on the correlation between the two markets can provide valuable insights for investors and analysts alike.

Global events such as economic crises, geopolitical tensions, and regulatory developments have a direct impact on both traditional and crypto markets. For example, during times of economic uncertainty, investors often flock to safe-haven assets such as gold and cryptocurrencies like Bitcoin. This flight to safety can lead to a positive correlation between traditional markets and crypto markets, as both asset classes are seen as stores of value in times of crisis.

On the other hand, regulatory crackdowns on cryptocurrencies in certain countries can have a negative impact on the entire crypto market, leading to a negative correlation with traditional markets. This was evident in 2021 when China announced a ban on cryptocurrency mining and trading, causing a sharp decline in the prices of major cryptocurrencies.

Overall, analyzing the influence of global events on the interconnectedness of traditional and crypto markets is crucial for understanding the dynamics of these markets and making informed investment decisions. By staying informed about the latest developments and trends in both markets, investors can better navigate the complexities of the financial world and capitalize on opportunities as they arise.

Predicting future trends by studying historical data of traditional and crypto markets

Studying historical data from both traditional markets and crypto markets can provide valuable insights into predicting future trends. By analyzing past performance, investors and analysts can identify patterns and correlations that may help forecast potential movements in the markets.

One key benefit of examining historical data is the ability to observe how traditional markets have influenced the crypto market and vice versa. Understanding these relationships can offer valuable information for making informed investment decisions.

Moreover, by comparing trends in traditional markets with those in the crypto market, analysts can gain a better understanding of how different factors impact both types of assets. This comparative analysis can help identify potential opportunities and risks in the market.

Overall, leveraging historical data to predict future trends in traditional and crypto markets can provide investors with a competitive edge. By studying past performance and identifying correlations, market participants can make more informed decisions and potentially improve their investment outcomes.