The Benefits and Risks of Long-Term Crypto Investments

- Understanding the potential gains of holding onto cryptocurrencies for the long term

- Exploring the risks associated with prolonged investments in the volatile crypto market

- Diversifying your investment portfolio with long-term crypto holdings

- Strategies for mitigating risks when investing in cryptocurrencies for the long haul

- The psychological impact of holding onto digital assets for an extended period

- Comparing the benefits and drawbacks of long-term crypto investments versus short-term trading

Understanding the potential gains of holding onto cryptocurrencies for the long term

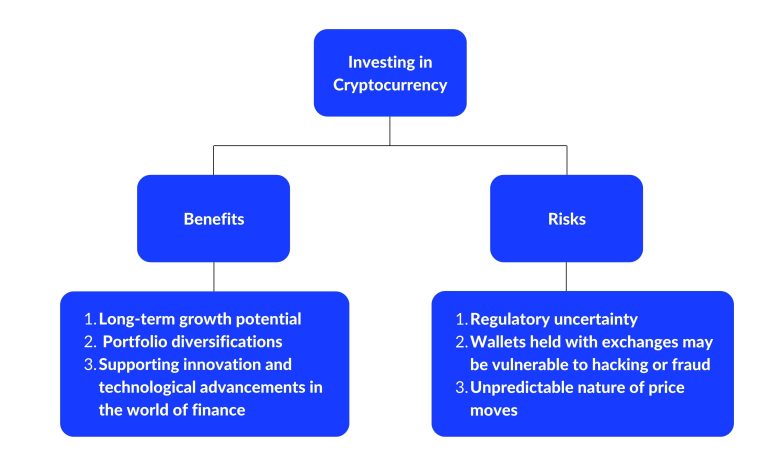

When considering the potential gains of holding onto cryptocurrencies for the long term, it is essential to understand the benefits that come with this investment strategy. One of the primary advantages is the opportunity for significant growth over time. Cryptocurrencies have shown a history of exponential growth, with some coins experiencing massive increases in value over the years.

Another benefit of long-term crypto investments is the ability to ride out market volatility. While the cryptocurrency market can be highly volatile in the short term, holding onto your investments for an extended period can help mitigate the impact of price fluctuations. This long-term approach allows you to weather the ups and downs of the market and potentially see substantial returns in the future.

Furthermore, holding onto cryptocurrencies for the long term can provide you with the opportunity to take advantage of compounding returns. By reinvesting any profits back into your portfolio, you can benefit from the exponential growth of your investments over time. This compounding effect can lead to significant wealth accumulation in the long run.

Exploring the risks associated with prolonged investments in the volatile crypto market

Investing in the volatile crypto market for an extended period can bring significant risks that investors need to be aware of. One of the main risks associated with long-term investments in cryptocurrencies is the high level of price volatility. The value of digital assets can fluctuate dramatically within a short period, leading to potential losses for investors who are not prepared for such market movements.

Another risk to consider is the lack of regulation in the crypto market. Unlike traditional financial markets, the cryptocurrency space is still largely unregulated, which can expose investors to fraud, hacking, and other illegal activities. Without proper oversight, investors may find it challenging to protect their investments and seek recourse in case of any wrongdoing.

Moreover, technological risks are also prevalent in the crypto market. As digital assets rely on blockchain technology, any vulnerabilities or bugs in the underlying code can lead to security breaches and financial losses. Investors need to stay informed about the latest developments in the blockchain space to mitigate these risks effectively.

Additionally, market liquidity can be a concern for long-term crypto investors. Some digital assets may have low trading volumes, making it difficult to buy or sell large quantities without significantly impacting the market price. Illiquid markets can result in slippage and increased transaction costs, reducing the overall profitability of long-term investments.

In conclusion, while long-term investments in cryptocurrencies offer the potential for substantial returns, investors must carefully consider and manage the risks involved. By staying informed, diversifying their portfolios, and adopting risk management strategies, investors can navigate the volatile crypto market more effectively and protect their investments in the long run.

Diversifying your investment portfolio with long-term crypto holdings

One way to diversify your investment portfolio is by including long-term crypto holdings. By allocating a portion of your funds to cryptocurrencies, you can potentially benefit from the growth of this emerging asset class over time. While crypto investments can be volatile in the short term, holding onto them for an extended period may help mitigate some of the risks associated with price fluctuations.

Long-term crypto holdings can also provide you with exposure to innovative technologies and projects that have the potential to disrupt traditional industries. By investing in cryptocurrencies with strong fundamentals and real-world use cases, you can participate in the growth of the blockchain ecosystem and potentially earn significant returns on your investment.

Furthermore, including crypto assets in your portfolio can help hedge against inflation and currency devaluation. Cryptocurrencies are decentralized and not subject to government manipulation, making them a valuable addition to a well-rounded investment strategy. Additionally, by diversifying into digital assets, you can reduce your overall portfolio risk and increase your chances of achieving long-term financial success.

Strategies for mitigating risks when investing in cryptocurrencies for the long haul

Investing in cryptocurrencies for the long term can be a lucrative opportunity, but it also comes with its fair share of risks. To mitigate these risks and ensure a successful investment journey, it is essential to adopt some key strategies:

- **Diversification**: Spread your investment across different cryptocurrencies to reduce the impact of volatility on your portfolio.

- **Research**: Thoroughly research the cryptocurrencies you are considering investing in to understand their technology, use case, and potential for long-term growth.

- **Stay Informed**: Stay updated on market trends, regulatory developments, and news related to the cryptocurrency space to make informed investment decisions.

- **Hodl**: Adopt a long-term investment strategy and resist the temptation to engage in short-term trading based on market fluctuations.

- **Secure Storage**: Use secure wallets and exchanges to store your cryptocurrencies and protect them from hacks and theft.

By following these strategies, you can minimize the risks associated with long-term cryptocurrency investments and increase your chances of achieving profitable returns in the future. Remember that patience and diligence are key when it comes to navigating the volatile world of cryptocurrencies.

The psychological impact of holding onto digital assets for an extended period

One aspect that is often overlooked when discussing the benefits and risks of long-term crypto investments is the psychological impact of holding onto digital assets for an extended period. This can have a significant effect on investors, influencing their decision-making process and overall well-being.

When individuals hold onto their crypto investments for a long time, they may experience feelings of anxiety, stress, or even fear. The volatile nature of the cryptocurrency market can exacerbate these emotions, leading to uncertainty about the future value of their assets.

On the other hand, long-term crypto investments can also bring a sense of security and potential for significant financial gains. Investors who are able to weather the ups and downs of the market may ultimately reap the rewards of their patience and perseverance.

It is essential for investors to be aware of the psychological impact of holding onto digital assets for an extended period and to take steps to manage their emotions effectively. This may involve setting clear investment goals, diversifying their portfolio, and seeking support from financial advisors or mental health professionals when needed.

Comparing the benefits and drawbacks of long-term crypto investments versus short-term trading

When considering investing in cryptocurrencies, it is essential to weigh the benefits and drawbacks of long-term investments versus short-term trading. Both approaches have their advantages and risks, and understanding them can help investors make informed decisions.

Long-term crypto investments offer the potential for significant returns over time. By holding onto assets for an extended period, investors can benefit from the overall growth of the market. This strategy is less susceptible to short-term price fluctuations and market volatility, providing a more stable investment option.

On the other hand, short-term trading allows investors to capitalize on price movements and take advantage of market fluctuations. This approach can result in quick profits if executed correctly. However, it also comes with higher risks due to the unpredictable nature of the crypto market.

Long-term investments are ideal for investors looking to build wealth gradually and are willing to weather market fluctuations. This strategy requires patience and a long-term outlook, as it may take time for investments to yield significant returns. In contrast, short-term trading is more suitable for active traders who are comfortable with taking on higher risks in exchange for the potential for quick profits.

Ultimately, the decision between long-term investments and short-term trading depends on an investor’s financial goals, risk tolerance, and investment strategy. It is essential to carefully consider these factors before deciding which approach to take in the volatile world of cryptocurrency investing.